pay indiana fuel tax online

The Indiana Department of Revenue DOR is transitioning tax accounts to its new online e-services portal INTIME to offer the ability to manage tax accounts in one convenient location 247. Other general taxes similar to excise taxes.

How Much Gas Tax Money States Divert Away From Roads Reason Foundation

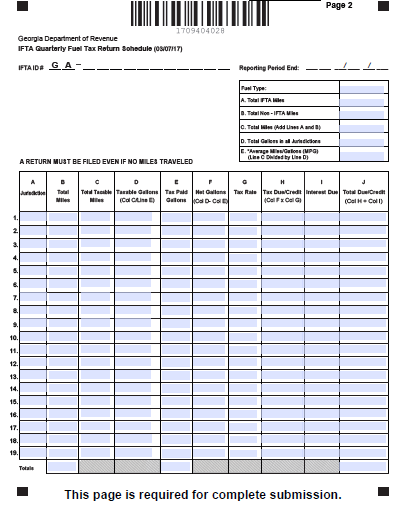

If you want to pay your IFTA taxes online you typically must open an account with the taxation or revenue agency in the state where your business is based.

. This rate will remain in effect through April 30 2022. Intax supports the ability to file and pay electronically for the following taxes. The Indiana Department of Revenue DOR is in the process of moving to its new online e-services portal INTIME which will soon offer all customers the ability to manage tax account s in one convenient location 247.

Search by address Search by parcel number. Search IFTA and the name of your state to find the correct website. Effective April 1 2022 the new prepaid gasoline sales tax rate is 202 cents per gallon.

Welcome to the Fuel Tax System Online Help. Your payment is due at the same time as your return. Retail sales Withholding Out-of-state sales Prepaid sales Metered pump sales Tire fees Fuel taxes Wireless prepaid fees Type II gaming fees Food and beverage taxes County innkeepers taxes Registering for INtax.

The due dates for filing and paying your quarterly tax returns are. INtax only remains available to file and pay the following tax obligations until July 8 2022. If you are having trouble searching please visit Assessor Property Cards to lookup the address and parcel number.

For best search results enter a partial street name and partial owner name ie. Fuel producers and vendors in Indiana have to pay fuel excise taxes and are responsible for filing various fuel tax reports to the Indiana government. Indiana per capita excise tax.

As of September 2021. Click the button below to view details on three IN fuel tax reports. Filing and Paying Taxes Indianas free online tool to manage business tax obligations.

Effective April 2018 IFTA Inc. It also helps to maintain your trip sheet for IFTA Audit. Indiana indiana fuel tax bond Bond is required by The Indiana Department Of Revenue to comply with the State licensing requirements.

Fuel producers and vendors in indiana have to pay fuel excise taxes and are responsible for filing. Search for your property. File all IFTA quarterly tax returns and pay any motor fuel taxes by the due date.

Locate your states website. PUC Claim forms -- Due by the due date of the quarter in which you are applying for credit. This rate will remain in effect through April 30 2022.

124 Main rather than 124 Main Street or Doe rather than John Doe. Texas State IFTA Fuel Tax File IFTA Return Online IFTA Tax DOR Online Services. Indiana State IFTA Fuel Tax File IFTA Return Online IFTA Tax.

Pay indiana fuel tax online. Taxes Home Texas Taxes. Prepaid Diesel Sales Tax Rate.

IFTA FUELTAX TRUCKINGIn this video I will show you how to file and pay your quarterly IFTA fuel tax. Make an IFTA payment. The 20 th of the following month except for Suppliers and Permissive Suppliers.

This includes making payments setting up payment plans viewing refund amounts and secure messaging with DOR customer service. Payment Plan Set up a payment plan online INBIZ Indianas one-stop resource for registering and managing your business and ensuring it complies with. INTAX only remains available to file and pay special tax obligations until July 8 2022.

Published April 30 2021. Home Pricing IFTA Permits About In California Jet Fuel is subject to a state excise tax of 002 per gallon. Indiana collects an average of 433 in yearly excise taxes per capita lower then 54 of the other 50 states.

Effective April 1 2022 the new prepaid gasoline sales tax rate is 176 cents per gallon. Is excited to announce we are looking for a dedicated individual to join our team to assist with various functions including accounting system implementation budget preparation learning management system lms. Online application to prepare and file Quarterly IFTA return for Indiana State.

The Indiana Department of Revenue DOR is transitioning tax accounts to its new online e-services portal INTIME which currently offers the ability to manage most tax accounts in one convenient location at intimedoringov. Pay Taxes Electronically Customers can quickly and securely pay their taxes electronically. Indiana Fuel Tax Fuel Tax Surety Bond 1 888 518-8011.

Use this form only if filing for the first 1st quarter of 2021. Indiana General Excise Taxes - Gasoline Cigarettes and More Indiana collects general excise taxes on the sale of motor fuel gasoline and diesel cigarettes per pack and cell phone service plans. Added hydrogen and electricity fuel types to the IFTA tax rate matrix.

The system was designed to provide motor carriers with a single source for all their fuel tax reporting in Indiana. Special Fuel SF-900 SF-401 Aviation Fuel AVF-150 Vehicle Sharing Excise VSE-103 Motor Fuel MF-360 Gasoline Use GT-103 Alcohol Tax ALC-W ALC-FW ALC-DWS ALC-M ALC-PS Other Tobacco Products OTP CT-19 OTP-M OTP-PACT. The Indiana Department of Revenue Motor Carrier Services Division Fuel Tax System software provides a browser-based means of taxation and motor carrier registration with internal access for support functions auditing and decal shipments and external access for motor carriers and service bureaus to.

Online application to prepare and file Quarterly IFTA return for Indiana State. Tax Liabilities and Case Payments. Fuel Taxes - IFTAMCFT.

IFTA fuel tax reports can be filed electronically using Webfile or EDI software or on paper using Form 56-101 International Fuel Tax Agreement IFTA Fuel Tax Report PDF and Form 56-102 IFTA Fuel Tax Report Supplement PDF.

Ifta Reporting Software Ifta Filing Online Quarterly Fuel Tax Reporting

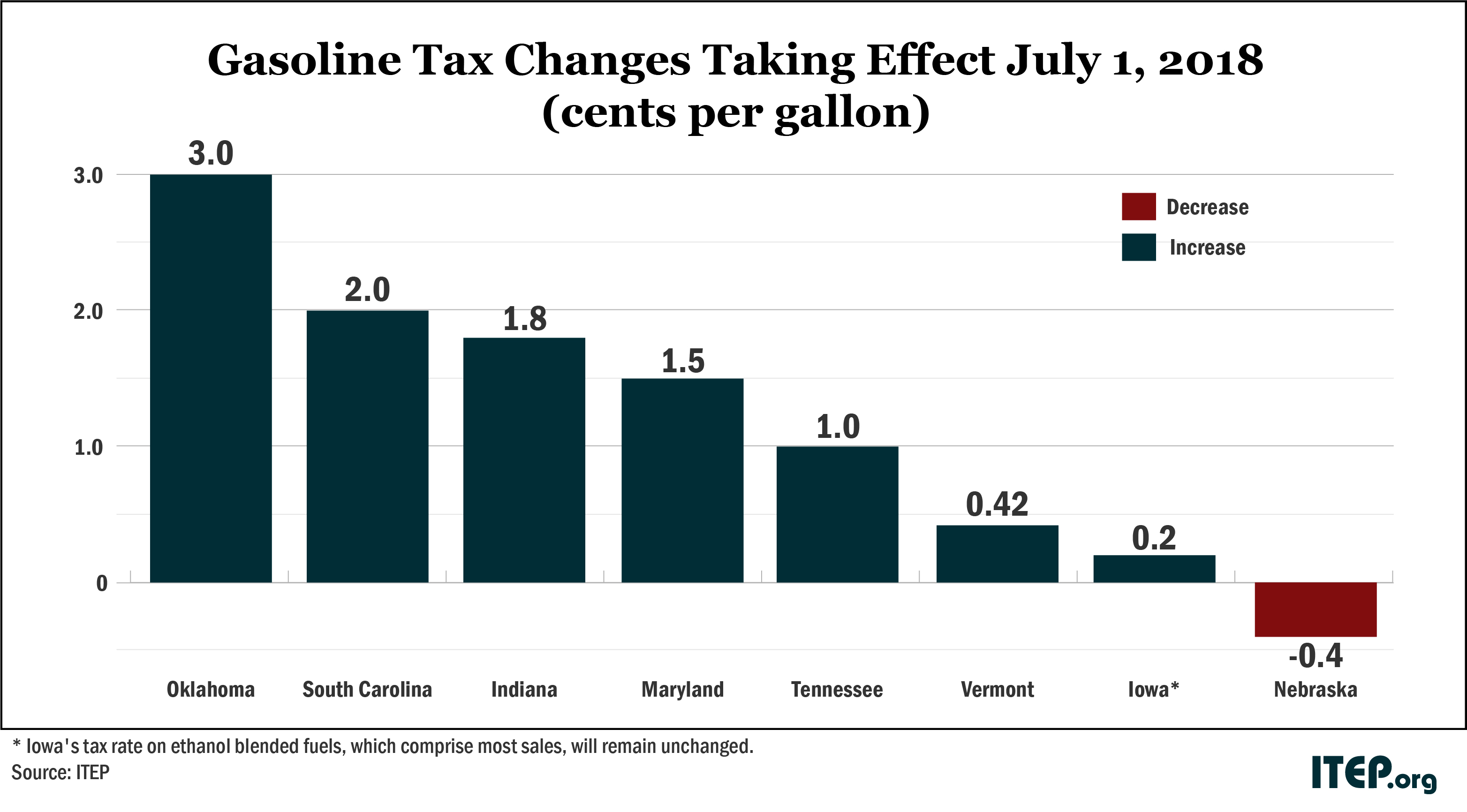

Gas Taxes Rise In A Dozen States Including An Historic Increase In Illinois Itep

Ifta Reporting File Ifta Quarterly Tax Return Ifta Tax

Illinois Doubled Gas Tax Grows A Little More July 1

Fuel Permits Ifta Permit Temporary Ifta Permits

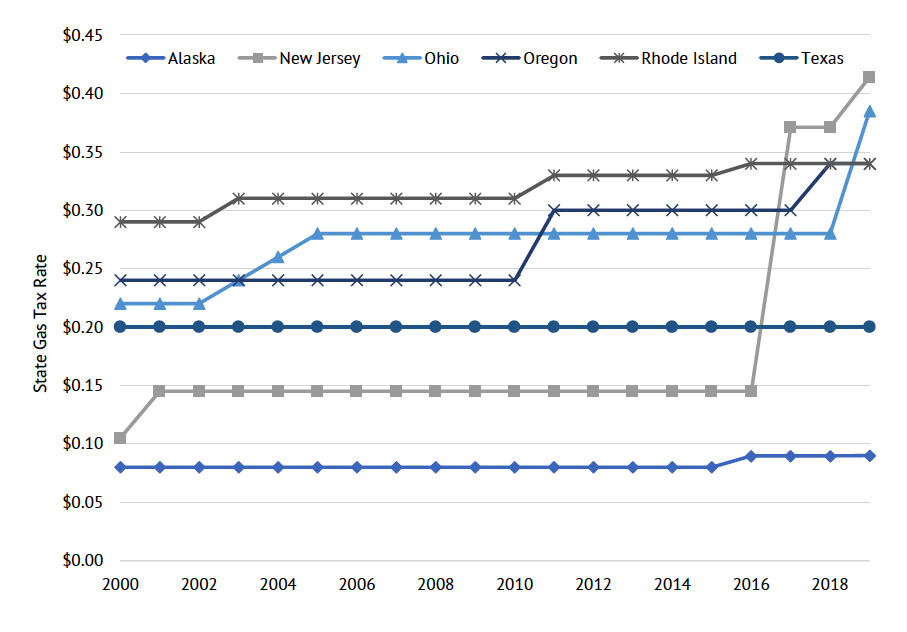

State Motor Fuel Tax Rates The American Road Transportation Builders Association Artba

Gas Taxes Rise In Seven States Including An Historic Increase In Oklahoma Itep

Ifta Reporting Software Ifta Filing Online Quarterly Fuel Tax Reporting

U S Gasoline Motor Fuel Taxes In January 2022 Statista

How Much Gas Tax Money States Divert Away From Roads Reason Foundation

Ifta Inc International Fuel Tax Association

Massachusetts State Ifta Fuel Tax File Ifta Online Ifta Tax

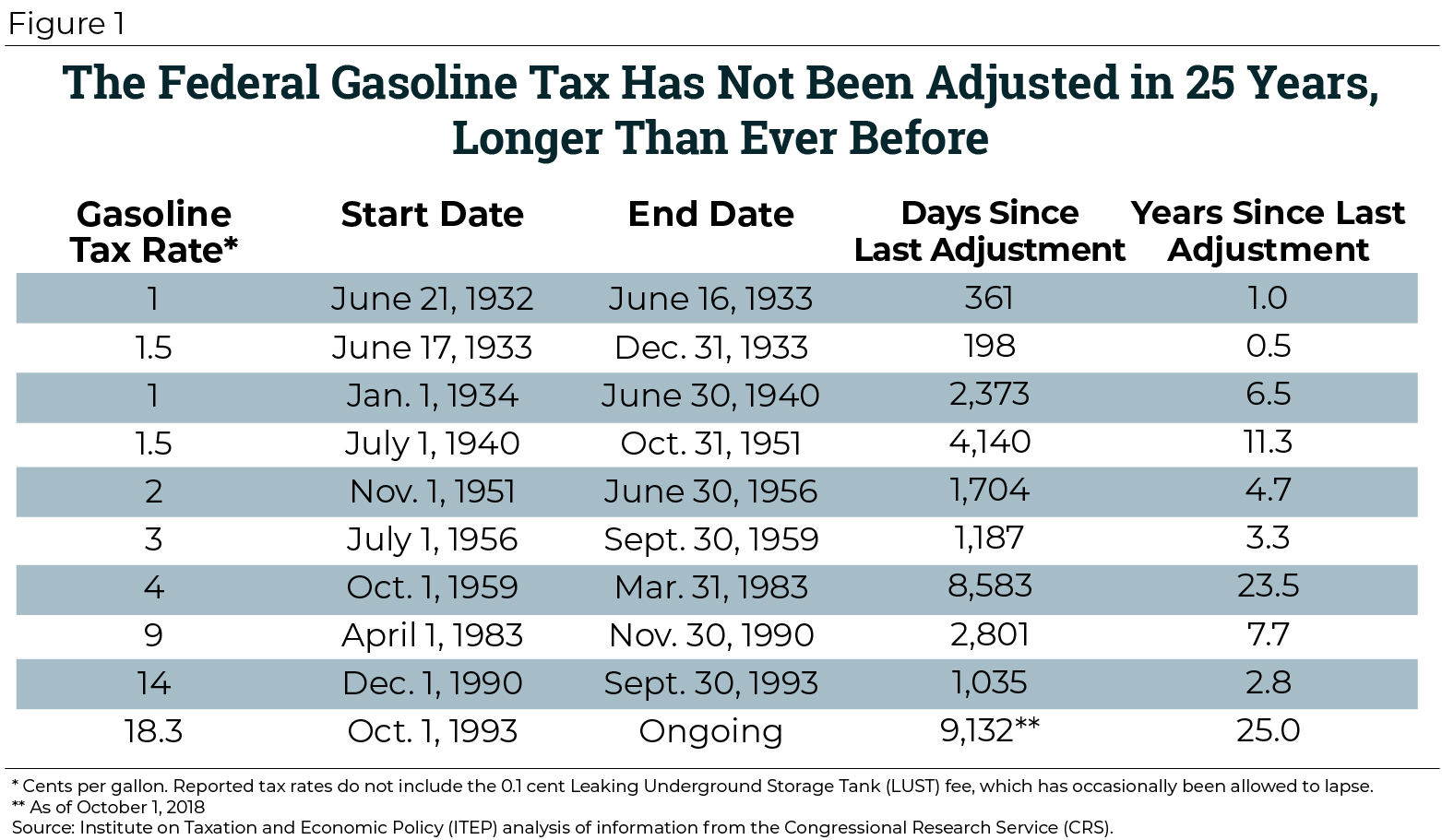

An Unhappy Anniversary Federal Gas Tax Reaches 25 Years Of Stagnation Itep

How Long Has It Been Since Your State Raised Its Gas Tax Itep

U S States With Highest Gas Tax 2022 Statista

3 Ways To Pay Ifta Taxes Online Wikihow

An Unhappy Anniversary Federal Gas Tax Reaches 25 Years Of Stagnation Itep

Homer Pro Software Full Version Free Download Freeware Free Website Schematic Design